a missing form or clarification on information included in the original return), they will generally send you a request via a letter in the mail. If the IRS wants additional information from you (i.e. The IRS will generally catch the mathematical mistakes and correct the errors while they process your original return. If you did not eFile your tax return, you may have made simple math errors or forgotten to attach certain forms. On Thursday, the IRS said it had received almost 93 million tax returns so far this season. Note that the IRS doesn’t accept amended returns electronically. Monthly interest will also accrue on the tax you underreported between the original filing date and the date you file the amendment.

#TURBOTAX 1040X AMENDMENT FOR FREE#

The TurboTax Audit Support Guarantee also includes the option to connect with an experienced tax professional for free one-on-one audit guidance. Therefore, changes you make to your federal return are likely to affect your state return. Most states calculate taxable income based on information you provide on your federal return.

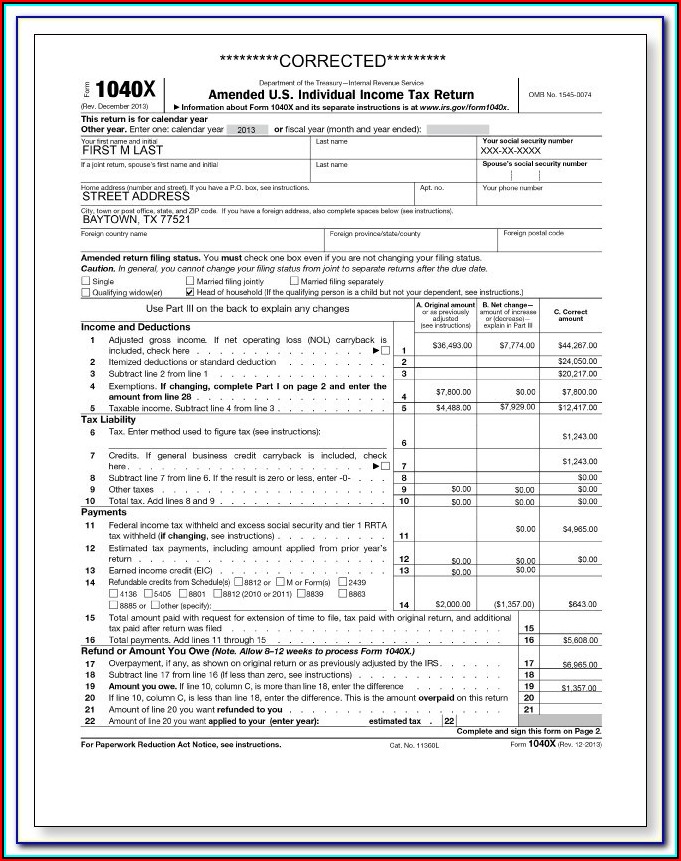

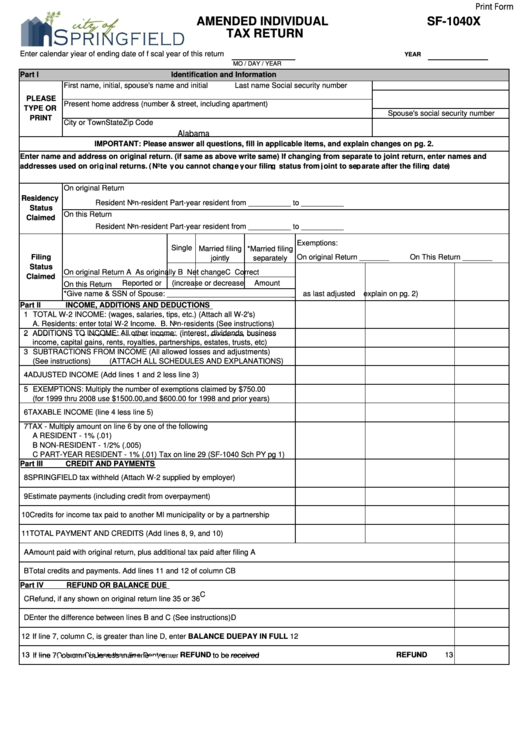

When you amend your federal tax return, you may need to amend your state income tax return too. Find out about state tax amendmentsand previous tax year amendments. If you did not use, you can use our online editor to complete the Form 1040-X below, print it and mail it to the IRS.

#TURBOTAX 1040X AMENDMENT PLUS#

Free Fed & State, Plus Free Expert Review.If also amending a state return, then a *physically* *separate* instruction sheet is printed for the state. When you finish amending and print, included in that printout will be an instruction sheet telling you what you need to include in the package you will be mailing to the IRS, as well as the address you will mail it to. But understand you will ***NOT*** mail the state amended return to the same place you will mail the FEDERAL return. If you also need to amend a state return, then the same holds true for the state. If amending the return will result in you receiving a refund then the absolute only way the IRS will pay that refund is by mailing you a paper check to the address shown on your return. AN amended return can take up to 16 weeks to process. You *HAVE* to print it, sign it (both the 10X if both print) and mail it yourself to the IRS. Note to all: An amended tax return can not be e-filed. Start the program and after the program starts, and *before* you click on your return to open it, click the AMEND button near the bottom of the screen. I don't see any section on the 1040X form "Personal you never will.

Note: It is possible that you will need to pay back some of the refund you received. It will then take 2-3 months for the IRS to process your amended return. The form you will need to prepare an amended return is called a 1040X. You amend to say in Personal Info that you can be claimed as someone else's dependent.

You have to change the answer you gave in Personal Info when you were asked if you can be claimed on someone else’s tax return. Wait until your return has been fully processed and you have received your refund. Your part of fixing this is to file an amended return. But they can go ahead and do that without waiting for you to amend your return. Your parents will have to prepare their return that claims you as a dependent and MAIL it to the IRS. So did you file a return that said no one else could claim you as a dependent and now your parent's return is being rejected? But really you can be claimed as their dependent?

0 kommentar(er)

0 kommentar(er)